No Results Found

We couldn't find what you're looking for.

Try different filters or search terms.

News

Events

Insights

Antibody Drug Conjugates

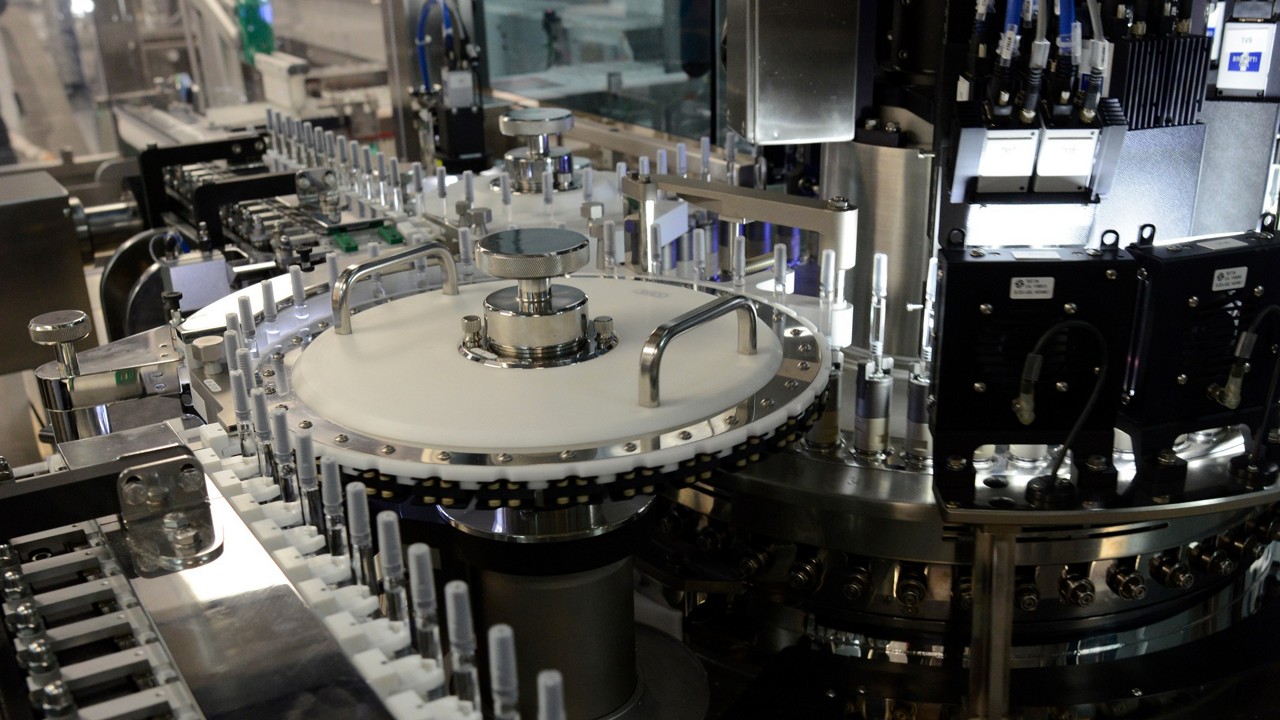

Aseptic Fill Finish

Biologics

Custom API

Eye Care

Hot Melt Extrusion

Oral Solid Dose

General